26+ biweekly payment mortgage

Web The biweekly method drastically decreases the amount of interest you pay for your home. By paying half of your mortgage payment every two weeks you make 26 payments per year instead of 12.

Biweekly Payment Calculator Credit Union Mortgage Payoff Pfcu

When you enroll in a biweekly payment program youre paying half your monthly.

. Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year. Web Biweekly Mortgage Payment Calculator. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Simply take your normal monthly mortgage. Doing some quick math here that. For every 100000 you borrow at 4 for.

There will be 26 withdrawals a year. Web Biweekly mortgage payments There is an alternative to monthly payments making half your monthly payment every two weeks. Web Biweekly AutoPay will automatically draft a half-payment from your account every 2 weeks 14 days.

Ad Compare the Best House Loans for March 2023. Web Youll make 26 payments towards your home mortgage with biweekly payments since there are 52 weeks in a year. Web A bi-weekly payment plan uses the calendar year to your advantage.

Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Get an idea of your estimated payments or loan possibilities.

Heres another way to look at it. Apply Get Pre-Approved Today. There will be 2 months during the year.

Learn how they work and the pros and. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. However if you choose to make biweekly payments youll.

Web Instead of having a biweekly mortgage company handle your monthly payment for a fee or having to make 26 payments a year. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. If you take 500 and multiply it by 26 payments you have 13000 in total.

Updated FHA Loan Requirements for 2023. When you make biweekly payments you could. Web Your monthly payment of principal and interest equals 138671 and adds up to 1664052 annually.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year. Compare More Than Just Rates.

Web Biweekly mortgage payments mean making a half-payment every other week rather than one full payment per month. Find A Lender That Offers Great Service. Web Biweekly mortgage payments are a way to schedule your payments to happen every two weeks instead of once a month.

When you enroll in a biweekly payment program youre paying half. Compare More Than Just Rates. Web Thats 26 half payments a year or the equivalent of 13 full payments a year instead of 12.

Find A Lender That Offers Great Service. By the end of the year you will have made. Try our mortgage calculator.

Check Your Official Eligibility Today.

The Mortgage Brothers Show Signature Home Loans Phoenix Az

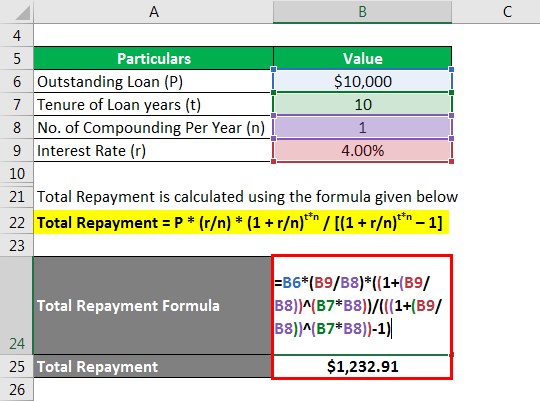

Amortized Loan Formula Calculator Example With Excel Template

Biweekly Mortgage Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator

Kamloops This Week June 19 2014 By Kamloopsthisweek Issuu

The Benefits Of A Biweekly Mortgage Plan Mortgages The New York Times

Biweekly Loan Calculator

Welcome To Bisaver The Best Biweekly Mortgage Payment System Bisaver Biweekly

Problem Setting Up Bi Weekly Mortgage Payment Schedule For Every Other Monday Quicken

Section C Shelter High Country Press

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

Do You Plan Your Updates Based On When More Popular Fic S That Are Writing The Same Ship As You Update Or Do You Just Post The New Chapter Regardless R Ao3

Ex99 2 005 Jpg

Efpknt68bnredm

Pros And Cons Of Making Biweekly Mortgage Payments Dan The Mortgage Planner

Biweekly Mortgage Calculator How Much Will You Save